A daily insight into changing behaviours during the cost-of-living crisis

We’re all familiar with the headlines surrounding the cost-of-living crisis and the impossible choices real people are making to get by. And though we appreciate the severity of some of these choices (heating or eating), we want to dig deeper to understand all the unexpected and unique ways people are navigating rising costs and what brands can do to help.

We’re getting a daily read, via WhatsApp, from 50 people across the UK, to uncover resourceful revelations of how we’re managing money – from the way we’re shopping, to the way we’re dating.

We’ll be regularly posting our insight here, so stay tuned below to see what we find.

Insight no.1: Thrifty Fifty

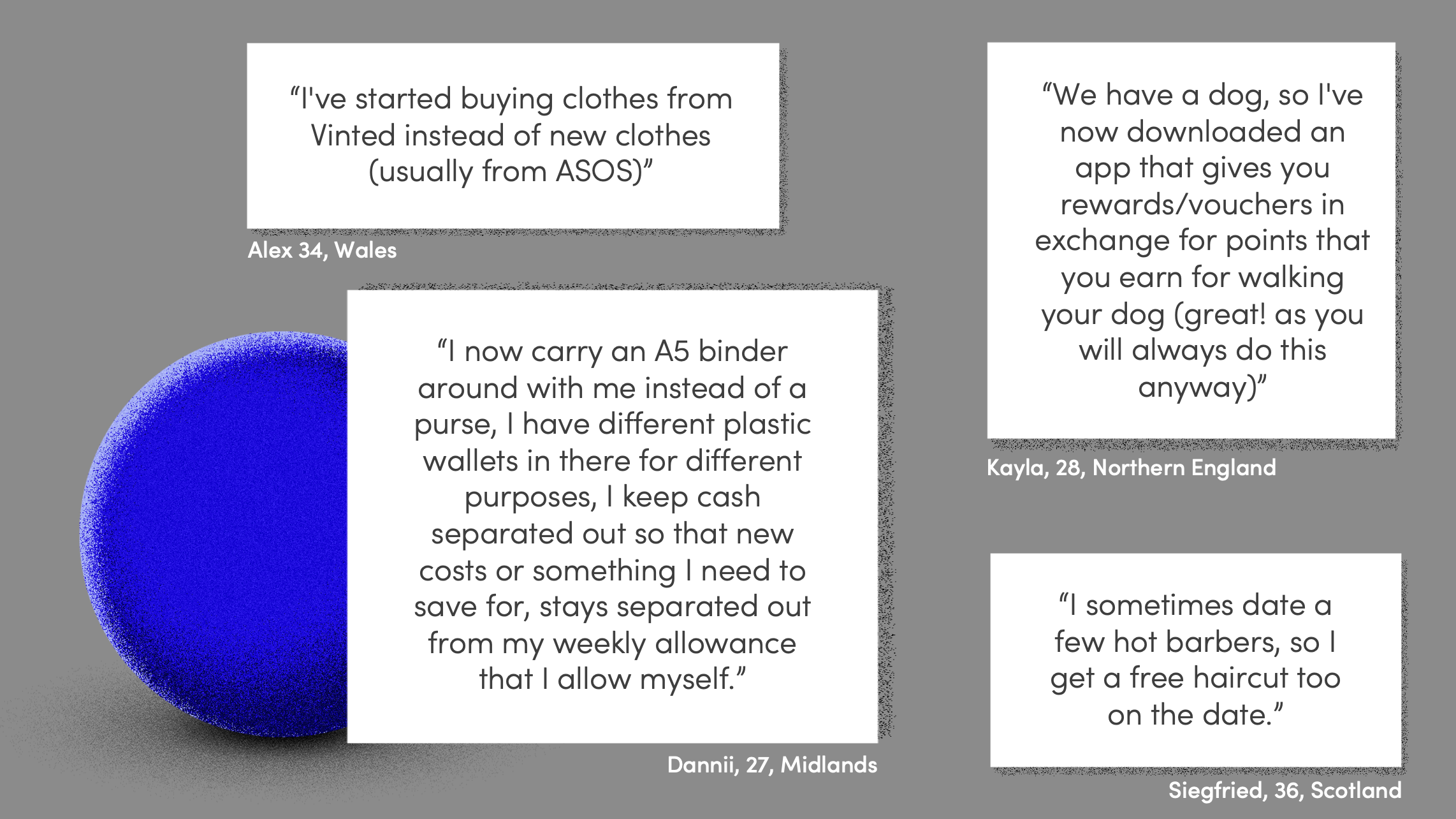

We’ve kicked off ‘On the Money’ by asking our panel what unconventional or different things they’ve started doing in order to manage costs.

We’ve seen a lot of people using second-hand platforms like Vinted to buy and sell, and also a surge of cash-back or rewards schemes that people didn’t make time for previously.

Home-style take aways, hand-made birthday cards and DYI diffusers… the nation is not only getting thrifty, it’s also getting creative with do-it-yourself-for-less coming through strongly.

Insight no.2: Adding to the at-home experience

With more people staying at home and looking for new ways to keep themselves and their families entertained, how can food and drink delivery brands better embrace adding entertainment to their home delivered products?

We’ve already seen Netflix adding games like Triviaverse to their portfolio and expand their offer, but can we imagine a world where Just Eat orchestrates a nation-wide game night to make the most of staying in?

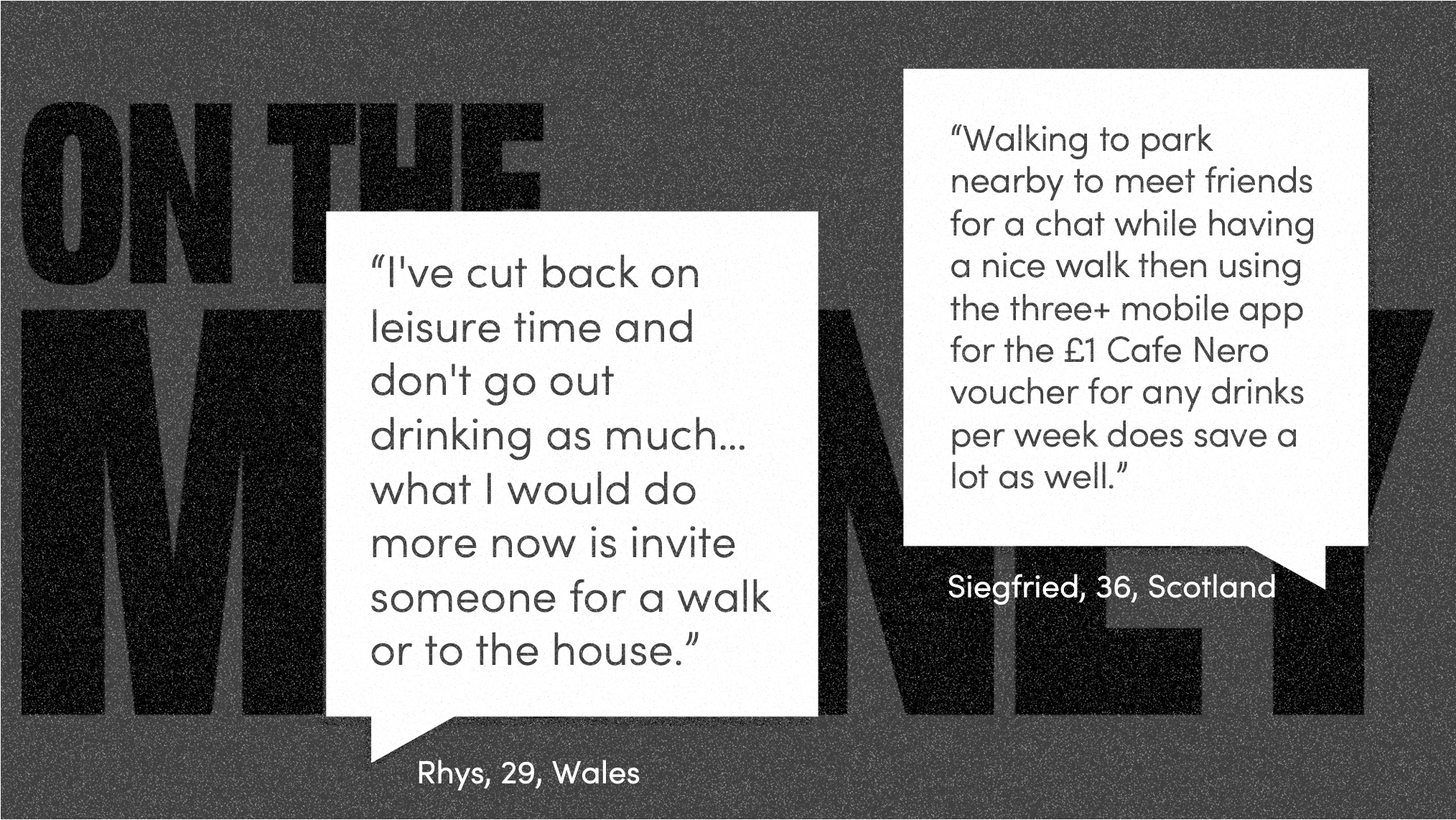

Insight no.3: More rewarding walking

People are going on more walks with friends to socialise, and as spring sets in, we’re expecting free outdoor activities to make a big resurgence.

Beyond podcasts and music, what can brands do to enhance the walking experience? The “Pokemon Go” phenomenon already showed how brands can add value to being outdoors. Can your steps equate to discounts on treats from your local area? Is there a ‘Strava x Amex Shop Small’ partnership waiting to happen?

Insight no.4: The Resurgence of Mystery Shopping

Some savvy people are signing up for mystery shopping services in exchange for great experiences for them and their families. Is mystery shopping back? Do twenty-somethings even know what mystery shopping is anymore? Now might be the best time for mystery shopping brands to get people’s attention.

Insight no.5: Making the Most of Memberships

People are now relying on and squeezing all they can out of memberships they may have previously neglected. Some are even taking on new memberships to get experiences at a discount. Naturally, popular memberships such as Odeon’s MyLimitless are winning. What membership-less brands could benefit from a members offer? Would Domino’s see a rise in sales if it offered 50% off all pizza’s to people who paid a membership?

Insight no.6: Disloyal Loyalty

In recent times, people across the UK have become loyal to the loyalty schemes that allow them to redeem products and services from a variety of brands, not just one. Multiple Tesco Clubcard members seem to be spending their rewards on vouchers for Pizza Express, for example. Does your loyalty scheme just bring people back to your brand? If so, you might want to try linking up with others.

Insight no.7: Social Sweats

One of the replacements for socialising is working out with friends. Working out as a social activity might as well be the foundations of brands such as F45, Crossfit, 1Rebel and apps like Nike Run Club. But how could your brand add in a social element? Are home workout equipment brands missing out by not giving people the option to connect with others in their area? Should the PureGym app have a friend section?

Insight no.8: Down with the Dupes

Socially accepted ‘dupes’ are on the rise. No too long ago, one wouldn’t proudly admit to wearing knock-off versions of perfume or shoes…but with rising costs, they are becoming a no-brainer choice for many. This is particularly interesting with fragrances. How do big brand fragrances continue to compete when smaller companies are selling similar smells at a fraction of the cost?

Insight no.9: Cutting the celebrations

As calendar occasions go, it seems like Valentine’s Day is one that people are skipping to save. The savvy among us are celebrating days like this much earlier – in order to escape inevitable price hikes. Are we going to see more people celebrating Mother’s Day early, too? How can brands embrace celebrations without adding extra pressure?

Insight no.10: Less consistent, more conscious charity

We assumed charity payments had gone down or completely stopped. While that’s sometimes true, many people have also pivoted away from monthly direct debits, in favour of one-off payments towards causes that speak to them. This behaviour is often coupled with skepticism about the way big charity donations are used. Could more charities benefit from asking for one-off donations towards specific projects/initiatives (GoFundMe style) instead of the classic “Give £X a month towards [insert broad issue here]”?

Insight no.11: Banks need to get Potting

Having saving or spending pots built into banking apps used to be a luxury. Now it’s pretty much a necessity for managing money day to day, but not all banks offer these features. We think they need to get cracking!

Insight no.12: Lotto Interest Heightens

People are either keeping their lottery bets going, or thinking about starting. For obvious reasons, we half expected this one, however, we’re still a little surprised to see multiple people reduce spending on alcohol, cigarettes and arguably more favourable gambling (sports betting) yet opting for debatably the most difficult to win gamble in the country.

Insight no.13: The cost of loving

People are having less sex, trying to go on cheaper dates, or not dating at all. We’re not only feel cash poor right now, but there seems to be less desire to take a risk with how we spend our time, if we’re not sure the reward will be worth it.

Can dating brands help make things better? What’s the affordable “Thursday” dating event where you can potentially find love on a budget? Should apps be getting creative with free-first-date ideas?

Insight no.14: Mystery Holiday?

After lockdown, people are naturally desperate to go on holidays. But with rising costs the question is, where’s affordable? One of our savvy participants divulged his strategy… mystery travel experiences!

Why aren’t more airlines packaging affordable mystery vacations? Could they easily channel traffic to lesser known, but equally enjoyable, destinations? Emerging brands like Journee are beating them to it.

Insight no.15: Supermarket Lotteries

We asked people what realistic loyalty perks they would invent if they could, and a “supermarket lottery” came up more than once! It reminds us of the hilariously insightful post from last Christmas, accusing Jeff Bezos of opting out of Santa Clause duties, despite having our wish-lists, shopping patterns, drones and the money to make it happen. Supermarkets…if you’ve not got this, you should start. If you’ve got this, you need to be advertising it?

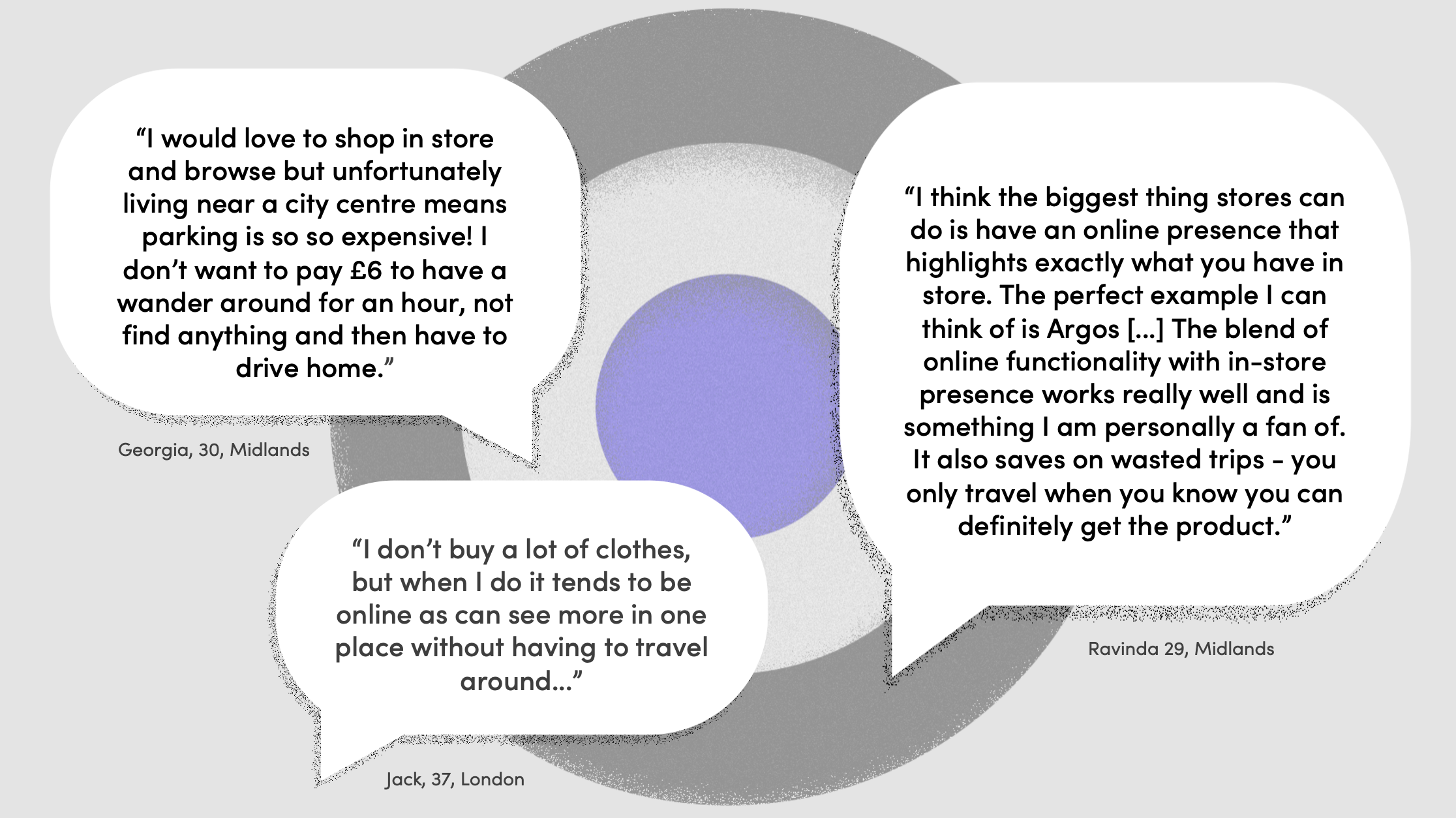

Insight no.16: The Argos Effect

We’ve all become impatient with services like Amazon Prime at our fingertips, and with a decreasing desire to browse shops for fun, people are opting for more efficient ways to purchase. What if all kinds of stores offered click-and-collect on the day of ordering, like Argos does…how much more footfall would we see if people were guaranteed to get their item that day?

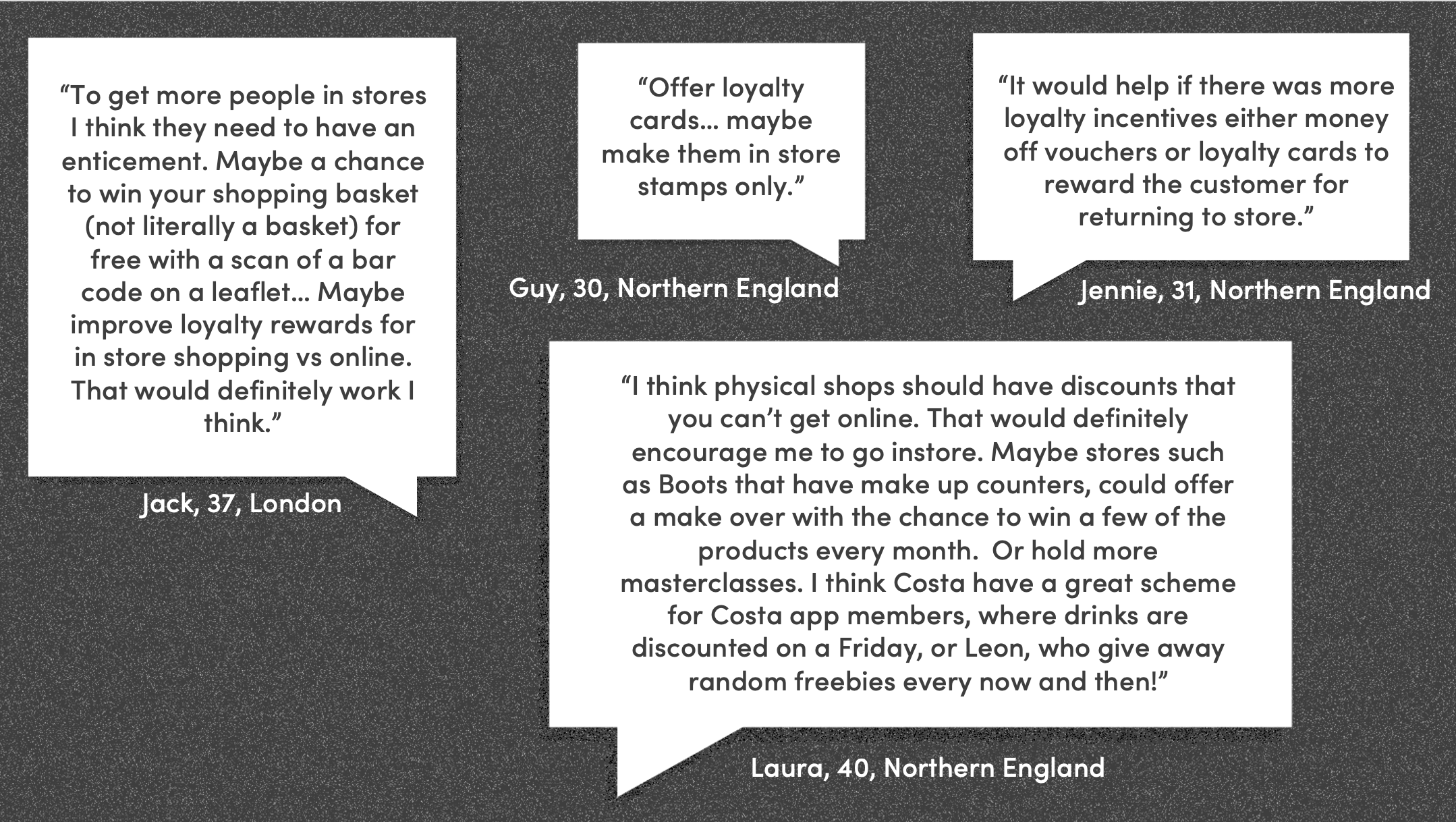

Insight no.17: Physical Loyalty

The people have spoken! They say if physical stores want to get them back in, loyalty rewards needs to better in-store than online. From double points to in-store tutorials/workshops, what can brands offer customers to make their shopping experiences in-store something worth returning for?

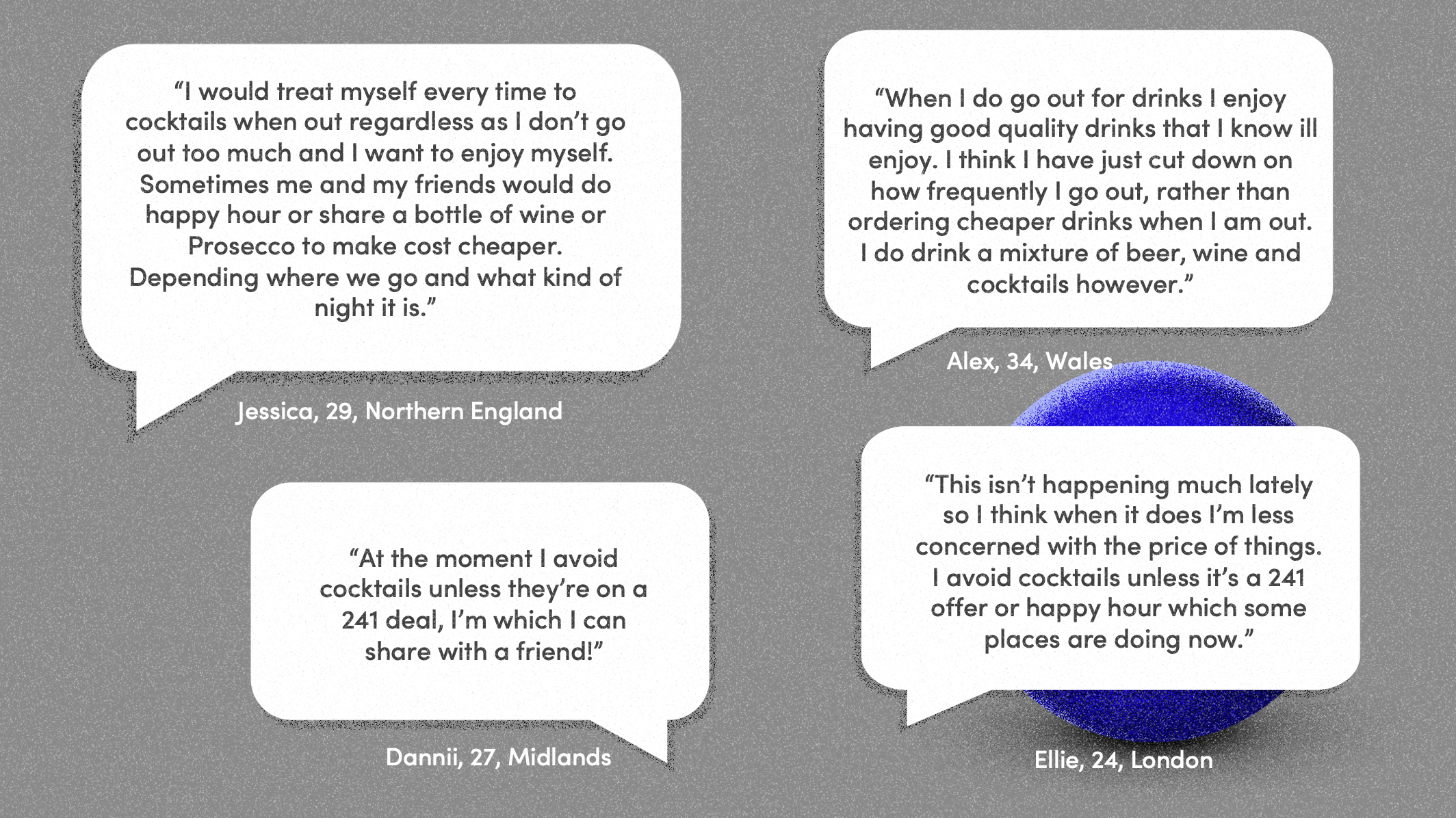

Insight no.18: Cocktails anyone?

We asked if people were still heading out to bars/pubs with friends and if so, what their drinking strategy was. As it turns out, lowering the frequency of drinking out, means making sure to get the most out of the experience while there. That deal on premium cocktails or mixed drinks has never looked more enticing. If we were a drinks brand, we’d be trying to own the happy hour right now, so people remember us when they’ve got more cash again.

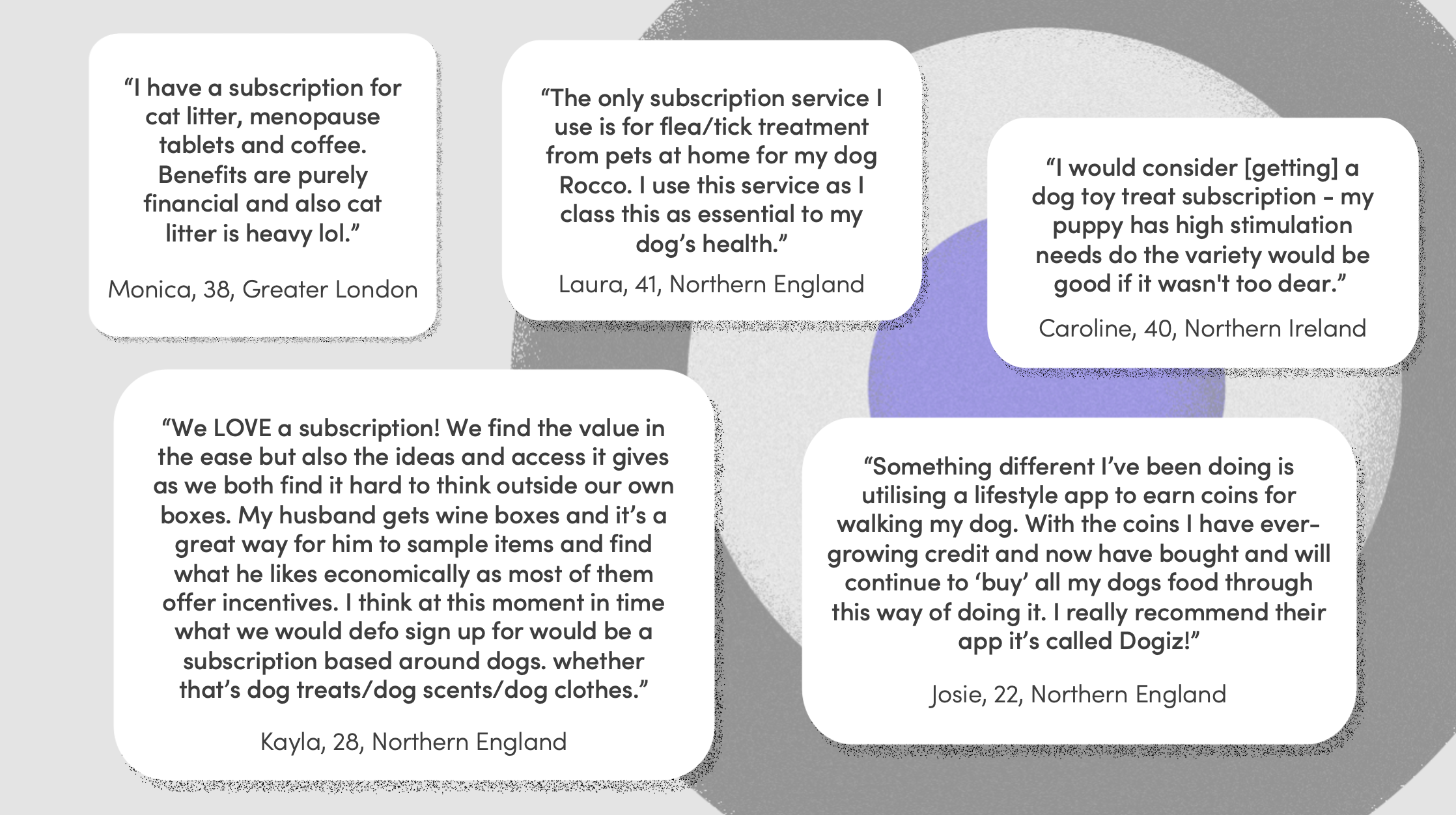

Insight no.19: Pets take priority

Pets have come up in responses a lot. People have paused other product subscriptions but are keeping pet subscriptions active, people without pet subscriptions say they would sign up for one, and even more people are using apps that reward them for going about their pet duties. We suppose it’s one thing to sacrifice your own happiness and another to sacrifice your pet’s. Pet brands, rejoice!

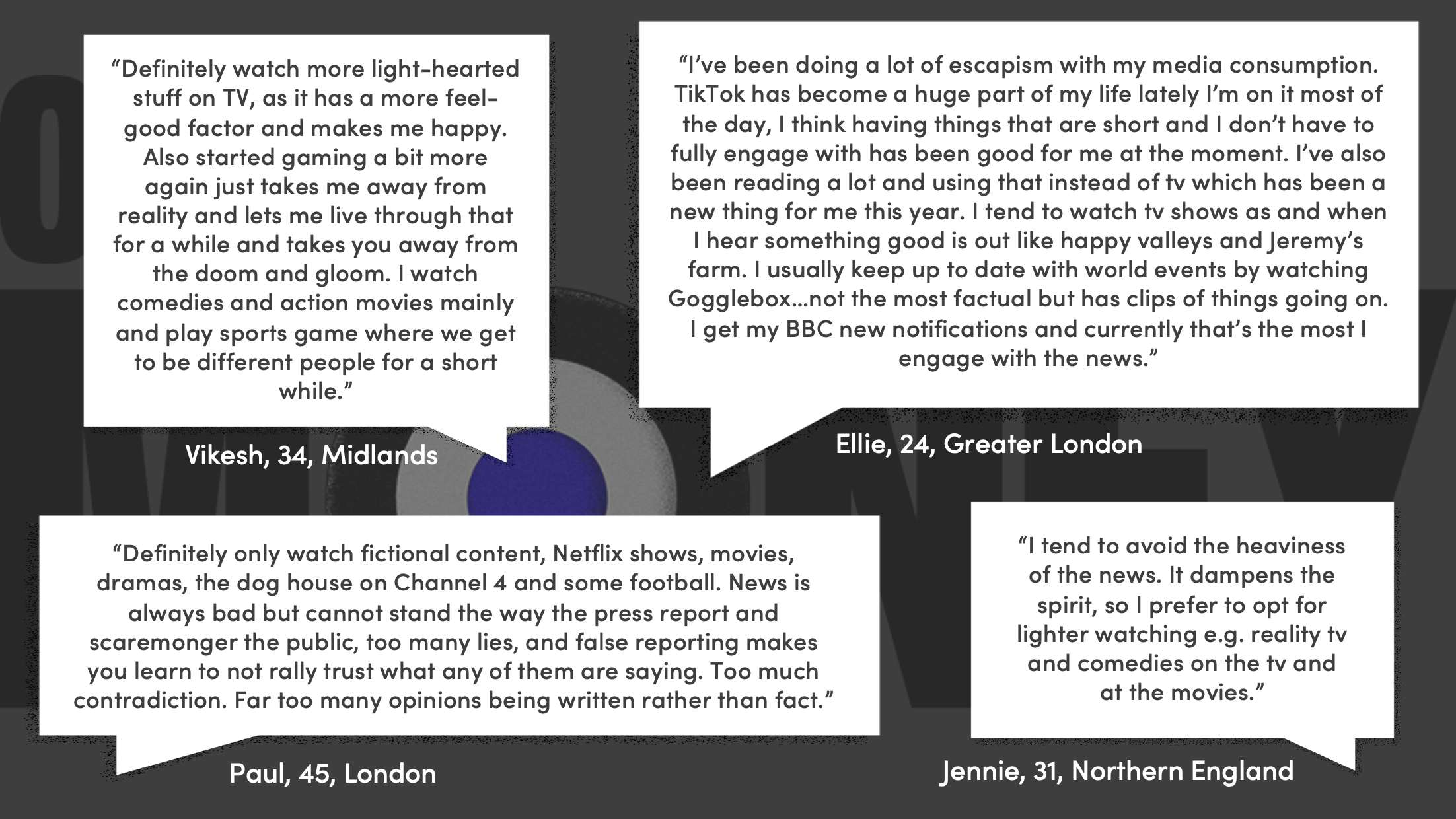

Insight no.20: Goodbye Reality, Hello Escapism

When we asked respondents to tell us about their media consumption, we assumed most people would be keeping a close eye on the news. As it turns out, people are tired of the doom and gloom: they’ve had enough. A lot of people just want lighthearted entertainment – TikToks, fictional shows, video games etc – to help them find moments of relief. Are your latest comms a joy to pay attention to?